And… rolling in the credit card debt. I know it’s usually the last thing that anyone ever advises, but having given it a lot of thought over the past year I believe we can make it work for us as an effective debt reduction strategy.

I’m a little blown away by what our credit union can swing. We currently owe $48K on our mortgage, with twenty three years left on the note. Our current finance rate is at 7.375%. Our current payment is $514 (this includes insurance and taxes which goes into our escrow account).

If we roll in $25K credit card debt, we would be shooting for a $77K mortgage with 5.125% interest, for a 20 year mortgage. The current payment would become $621 (including insurance and taxes). And we’d be able to pay off the mortgage faster (twenty years vs. the twenty three remaining).

There are a lot of factors coming into play for this to work. First of all, our options are limited, since we live in a manufactured home. Not a lot of lending companies want to carry manufactured homes, and I find that most really prefer the mortgage to be significantly higher than $77K (they don’t make a lot of money on such a small mortgage).

The credit union can only loan us 65% of the value of the property, so if the property is worth $120,000 they can give us a $77,000 loan. First of all, our home and property must be assessed at $120,000 or more in order to get the $25K cash back to pay off the credit card debt.

The closing costs will be $2341, if my credit score is over 740.

However, much to my chagrin, at this writing, Equifax reports that my score is at 722.

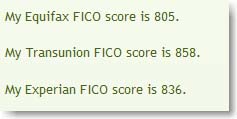

Check out my scores back in 2007. I’m weeping.

Here are the key factors affecting my score:

- The amount owed on your revolving/charge accounts is too high.

- The proportion of balances to credit limits (high credit) on your revolving/charge accounts is too high.

- The time since your most recent account opening is very recent.

- You have recently been seeking credit or other services, as reflected by the number of inquiries posted on your credit file in the last twelve months.

Number 3 links to back in September 17th of last year when I was applying for several new credit cards, in order to move our debt to 0% cards. I do not recall applying for anything else in the past year, so my hope is that my credit score will rise a few points once the twelve months has passed.

Just for fun, I checked with CreditKarma and they estimated my score as 732.

Since Mr. A is still building his credit, they won’t be using his credit to secure the mortgage (although of course his name will be on the mortgage).

If at the time we apply for the mortgage my credit score is still under 740, the closing costs will rise from the aforementioned $2341 to approximately $3141 (but only $495 will need to be paid out of pocket). The rest can be rolled into the loan. No PMI will be required.

According to Zillow.com our home and property is worth $134,000. We will have to have a full appraisal, which will cost around $400.

The credit union says we should first ask a realtor in the area if they could give us an idea of what our property will be worth, before we pre-qualify for the loan.

I downloaded this very fantastic FREE for personal use Loan Amortization Schedule spreadsheet from Vertex42 and checked out some of the numbers. Currently we are paying about $800 a month toward our credit card debt ($425 is the minimum, so we are paying about double). The new mortgage would be about $100 more, so if we applied that extra $700 each month we could have our entire mortgage paid off in 6 1/2 years!

I’m also hoping that we’ll have the option of itemizing our deductions on income taxes since we’ll be able to claim the interest. Two of the credit cards are at 0% interest, with the 0% interest period ending soon. Two cards are already accruing interest, so I need to get them moved to 0% offers. Refinancing and rolling in the debt will help to ease up our cash flow, and we can still pay the excess toward the mortgage. Mr. A’s businesses are bringing in money, but some months are lean, so wiping out the credit card payments would really help in those months.

I am a little scared because I have heard too many horror stories about people consolidating their debt, then running up the credit card debt again.

I’ll let you know what we end up doing.

Yours Truly,

Why would you want to roll in the credit card debt? Re-financing your mortgage for a lower rate makes sense if you’ll be able to recoup the closing costs in the amount of interest you’d save and then some. However, rolling in the credit card debt makes that unsecured debt go to secured debt. Should you lose your job or ability to earn income, you now owe more secured debt. You could lose your house over credit card debt! That doesn’t sound like a good plan to me. I’d look at re-financing just the amount owed on the mortgage and keep the credit card debt separate.

[Reply]

Mrs. Accountability Reply:

September 4th, 2009 at 4:52 am

Hi Cynthia, I know, I know. It’s totally not the “right” thing to do. I’ve been thinking about it for more than a year now and keep coming back to the same thing, that it’s just plain wrong. We haven’t made any firm decisions yet; I need to rework the numbers and compare just getting the mortgage redone at the lower rate. Here’s the thing though, I can keep moving the credit cards over to 0% interest but for how long? I don’t think the credit card companies are going to continue with these deals as they have already been dwindling down. Redoing the mortgage not only decreases the current loan by 3 years, but maybe, just maybe we’d be paying enough interest that we could actually use our mortgage to itemize our taxes. Let’s say that the credit card companies stop offering 0% interest, and the lowest rate I can get is 8%. I’m still going to be paying interest for years and years. I will admit that I’m deathly afraid that we will “need” to use the credit cards again, and start this all over. I know we have to change our ways, or it will. The other reason you mention, that we could lose our home… well, the new payment will only go up by just over $100. Right now, the minimums on the credit cards is around $400. The house payment is $514. If we lose our income altogether, then it’s going to be harder to come up with $914 than $600. Would we just put up with bill collectors at that point and not pay the credit cards? Lots of questions. Thank you for taking the time to offer your thoughts on the situation, it gives me pause to think. Thanks for visiting and commenting, Cynthia!

[Reply]

Seems like a smart move to me. It should improve your cash flow, and that should make it less likely, not more likely, that you’ll default. Since it will take many years to pay off the credit cards at an astonishing $400/month plus whatever more you can scrape together, the fact that rolling the credit-card debt into your home loan saddles you with that debt for as long as you live in the house doesn’t much matter. But it has the dual benefit of not only knocking the payment into the affordable range but converting it to a small tax advantage.

You’re not proposing to borrow more than the house is worth. Real estate is at or near the bottom now, and so there’s a good chance your equity will begin to rise. This is probably a very good time to take the plunge.

One thing that will make this a REALLY smart move: Resist charging up anything more on the cards. Take the extra $300/month and put it into a fund for emergency costs and big purchases…that should help.

[Reply]

Mrs. Accountability Reply:

September 9th, 2009 at 5:55 pm

Hi Funny, thank you for the vote of confidence. I really like your suggestion that we save up the extra money each money for an emergency fund. That would make me feel much more confident. Thanks again for your input, I very much appreciate it! Mrs. A

[Reply]