Mr. A has dealt mostly with cash in his life, so in February of 2008 I had him apply for a secured credit card so he could begin building his credit. We put $600 into the bank, and they held onto it while we used the card to buy gasoline and paid it in full each month. Before I had him apply for the card, I tried to pull his credit report, but I couldn’t get any information online (they required that we mail in a paper application by snail mail). I guess no credit is better than bad credit. One year later, in February 2009, he had “graduated” to an unsecured card with a limit of $1100.

The other day I was looking at our credit scores, in anticipation of refinancing our home. I checked Mr. A’s score through CreditKarma, and then I went through Equifax and ran his report. His score at CreditKarma was 743. His credit score through Equifax was 723. In November 2008, it was 666.

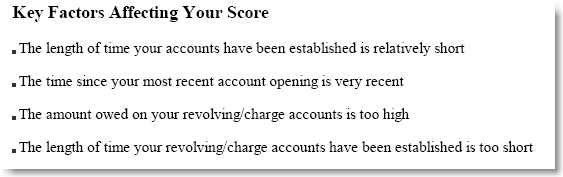

Here are the factors affecting his score (even though Equifax states his score is “very high”:

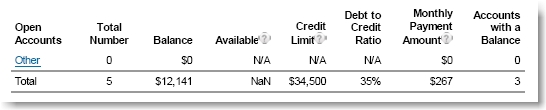

I learned some interesting things. I had Mr. A added to several of my credit cards, and since he is an authorized user, these cards showed up on his account. They appear to be building his credit. His debt to credit ratio looks pretty good:

I learned that the past due child support which he owed the state for our children, is his longest standing account because it was opened nearly seventeen years ago. Unfortunately, it is considered a negative on his credit report. It states the account status is paid as agreed since February 2008 and has been closed.

I learned that his business credit card does not show up on his personal credit report. I assumed that it would, but I guess maybe it wouldn’t, since it’s not a personal credit card. The credit union inquiry for his credit union checking account does show up on his credit report, as does the bank that holds his company credit card.

I ran the reports on October 15th. His score at Equifax was 723. His score at CreditKarma was 743. I ran his report at Experian, but did not pay for the score.

Today I went to CreditKarma again and updated his score, and it has gone up to 728. If Mr. A’s credit score keeps going up like this pretty soon we’ll be able to use both our credit to refinance our mortgage. The credit union told us if my score was better than Mr. A’s that they would use my credit, and if my credit score was over 740 that we’d save $800 in closing costs.

I am very curious to see how his score will be affected because one of the credit card accounts listed under his report is the one we just paid in full. This means his credit limit will remain $34,500 but the balance owed will drop to $3212. This means his debt to credit ratio will go from 35% to 9%.

Even though both our names are on our personal checking account, it does not show up for him on his credit report. The $20K line of credit doesn’t show up for him either, and it is connected to the same accounts. The only account from this bank that shows up is his unsecured card with the limit of $1100.

Very interesting.

Yours Truly,

really interesting article. I have a low score..so I have to check what’s keep me the low score..maybe I can improve a little. Anyways, thanks for sharing.

[Reply]

Mrs. Accountability Reply:

November 6th, 2009 at 12:45 pm

Debt Leads: I hope you are able to figure out what to do to help your credit score! Thanks for stopping by and commenting!

[Reply]

Between me and my wife we’ve had more prepaid credit cards over the years than I can count, including Current, Greendot, etc. But, the last few years we have found that one is the best for our needs AccountNow Visa. Why? Because I was ecstatic to discover how well-designed and smooth to use the underappreciated (and widely mocked) AccountNow Visa’s are.

[Reply]

Mrs. Accountability Reply:

December 13th, 2009 at 6:48 pm

Mike, I’ll have to look into this card. Thanks for sharing, and thanks for stopping by and commenting!

[Reply]